By Hussein Askary* and Paul Gallagher**

Economists, think tankers and governmental institutions are fervently debating the shape of the world economy in the wake of the COVID-19 pandemic. “Who will be the winners and who will be the losers” is often the question asked. However, there is little or no discussion about the state of the world economy, especially the Transatlantic region before the outbreak of the Coronavirus. Failing to learn from the lessons of past crises will doom the world to repeating the same mistakes that made us vulnerable to the Coronavirus. Leaders in the U.S. and Europe are waiting for the time when “things can go back to normal”. But there is no normal to go back to, because the Western financial and banking systems were heading into a new collapse before the Corona outbreak, most emphatically from August-September 2019. Besides, hunger, poverty, and lack of basic services like health care were rampant across large swaths of the globe before COVID-19. The lessons, both positive and negative, that were not learned from the 2008 financial crisis came back to haunt the world system again in 2020. The reaction to the 2008 financial crisis in the West and Japan was diametrically opposite to the one adopted by China. While the Western system focused on saving the financial corporations and investment banks that created the financial bubble causing the crisis in the first place, China focused on saving its physical economy and productivity. It is the reaction to that crisis that catapulted China to the position of the first economy in the world, while it pulled down the EU and U.S. into deeper economic and social crises.

Quantitative easing

In response to the 2008 financial crisis, the “big four” central banks of the United States, the European Union, Britain, and Japan created or “printed”, by rough estimates, $13-14 trillion equivalent in money from late 2008 to 2018 (by “quantitative easing” programs), and have issued temporary liquidity loans to banks in the many trillions of dollars equivalent in addition. But none of that money—new currency and electronic entries—has been created for an economic purpose, nor for a trade purpose. It has all been created for a strictly financial purpose: providing the largest banks in these countries with enough capital and liquid reserves to survive massive losses and bad debts.

Many of the economic experts debating the shape of the post-COVID19 world miss the distinction between the two approaches. For example, Swedish economist Christer Ljungwall did the same during a webinar hosted recently by the Swedish Foreign Policy Institute (Ui). In response to a question on whether “China can afford to deal with” the current crisis. His answer was: “Yes, and that is largely for two reasons, the first is because the Central Bank has a great room to maneuver, in particular when it comes quantitative easing”. While the first part of his answer is correct, the second one is very misleading. The other reason he gave is that “China’s budget deficit as share of GDP is minor. So, they can run fiscal deficit for substantial time.” What makes economists make such general statements based on formulas taught as economic science is the lack of distinction between money and credit, between increased productivity and profit making. Therefore, they cannot answer the question why, despite all the massive quantitative easing conducted by the western central banks, the physical economies of Europe and the U.S. continued to collapse.

In addition, already in September 2019, the financial and banking system getting closer to a new crash. This threat prompted the U.S. Federal Reserve to pump new liquidity into the system to avert a new chain-reaction collapse of several banking institutions. The Federal Reserve launched a massive and new bailout, in the form of overnight “repo” lending, which until late November 2019 was averaging approximately $70 billion a day! Additionally, the Fed reversed its policy of tightening and selling off assets and started purchasing $60 billion per month in mostly worthless assets from banks. This was going on while the U.S. President Donald Trump was bragging about the historic rise of the U.S. Stock markets with the Dow surpassing 28,000 points. This shows the discrepancy between reality and the financial system, something which passes almost unnoticed by policy makers and economists in general. Only the frustrated low-income strata of the population are aware of the reality of the real economy. They have noticed no real improvement in their living conditions and wages since the mid-1970s.

However, even under the Corona Pandemic, there are still today no signs that the obsolete quantitative easing is going to be abandoned. When the Corona pandemic struck the global economy in early March, the financial markets were already ripe for a collapse, and historic crashes of the stock markets were recorded. The knee-jerk response by the U.S. and European central banks was to open the flood gates of money again. By the week ending on May 20, the Federal Reserve’s asset book reached $7.098 trillion. Coming on top of the quantitative easing practiced by the Western central banks reaching $20 trillion in printed money from 2008 to 2020, $5 trillion were “printed” in 2020 alone. The shocking factor is that this money is being created and dispersed to financial markets and banks at incredible ease and swiftness, with the decisions by the central banker bypassing the elected parliaments and governments. Afterall, the central banks are deemed to be independent. In the meantime, any new policies to improve the living conditions of the population through issuing new credit for real economic growth, social programs, and necessary infrastructure building can take from months to years to pass the parliaments and corridors of power in Europe and the U.S. The usual excuse provided by “economic experts” for not supporting such real economic programs is that they can result in “increased inflation”, while the hyperinflationary printing of money by the central banks is deemed necessary to maintain the “system”.

Productive Credit vs Debt

According to the late American economist Lyndon H. LaRouche, true economic value lies not in money or in natural resources, but rather in the creative, productive powers of labor, and in increasing this power through scientific and technological advancements. All policies in society, including the issuance of money and credit should be geared towards improving the productive powers of labor, which includes financing and building a platform of basic economic infrastructure (transport, power generation, water management, healthcare, and education, including science-driver programs such as nuclear technology and space exploration programs). President Xi Jinping has expressed a clear understanding of this concept, and he frequently reminds his Communist Party comrades of the importance of this principle in defining China’s development strategy. In a speech he delivered at a 2014 seminar commemorating Deng Xiaoping, Xi said: “The chief criterion he [Deng Xiaoping] put forward for judging any action is ‘whether it promotes the growth of the productive forces in a socialist society, increases the overall strength of the socialist state, and raises living standards.’ ”

In another speech he delivered the following year, President Xi stressed the importance of innovation in the field of science and technology as a measurement of economic growth. “We must consider innovation as the primary driving force of growth and the core in this whole undertaking, and human resources as the primary resource to support development,” he stated. In the same speech, he emphasized that “The US took the opportunity of the second Industrial Revolution in the mid-19th century and surpassed the UK, becoming the number one world power… The US has maintained global hegemony because it has always been the leader and the largest beneficiary of scientific and technological progress.”

The correlation between the development of advanced infrastructure and the increase in the productivity of the economy is thoroughly proven from studies conducted on the U.S. economy itself.

When discussing any issuance of money/loans, the real question that has to be asked is not the terms of the loan (interest rates, grace periods, or repayment duration) but rather, what the purpose it is issued for. It is, therefore, most important to distinguish between “money” and “credit.” To understand the difference, it is crucial to consider the ends to which new supplies of financing or debt are applied. Credit issued by governments is a debt those governments assume, which will be “paid back” with “interest” by the greater overall productivity of a future generation. Essentially, growing future productivity is the security for the issuance of credit.

China’s reaction to the 2008 crisis was shaped by this “intention”, not simply to save the “markets”. The “big four” public commercial banks of China (Export-Import Bank, China Construction Bank, China Development Bank, and China National Agricultural Bank), issued nearly as much new currency—“money”—in the form of loans, as have the US, EU, UK and Japanese central banks in the same period between 2008 and 2018 (equivalent of $US$ 14 trillion). However, the lending of the Chinese banks has fostered extraordinary new platforms of transportation, navigation, water management, power production, agricultural production, and scientific research in the Chinese economy. This process enabled China to reach the goal of lifting hundreds of millions of Chinese citizens out of poverty. By end of 2020 the goal is to have zero Chinese below the poverty line. Beyond China, these Chinese banks have now extended roughly $300 billion since 2014 in additional credit for infrastructure projects outside China through the Belt and Road Initiative.

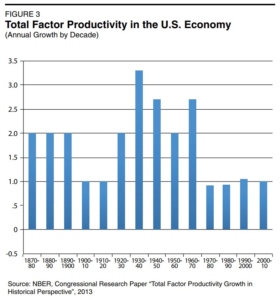

The result of these policies in the past two decades in China has been an extraordinary 8-10% of GDP invested in economic infrastructure, leading to a multi-factor productivity growth averaging 3.11% annually from 2001-2014 according to the Bureau of Economic Analysis in the United States. This compared to U.S. multi-factor productivity growth of under 1% since the 1970s.

Total factor productivity

There is a strong relationship between credit issued for projects of new infrastructure and multi-factor (or, total factor) productivity. This latter parameter attempts to measure that rate of growth of an economy due to technological advances. The highest annual rate of growth of American productivity, thus measured, occurred in the periods in which the greatest investments were made in new infrastructure that required new technologies—road, canal, rail, and later space transportation technologies, electric power technologies, water management and flood control technologies, and communications. The most rapid growth of multi-factor productivity was the 3.30% annual rate of the 1930s, under President Franklin Roosevelt’s New Deal re-employment and massive “Four Corners” infrastructure programs, According to a 2005 report by the U.S. National Bureau of Economic Research.

China’s High-Speed Rail Miracle, for example

The same close connection exists in much more recent history in the last 20 years of China’s economic growth. Extraordinary rates of investment in transportation, water management, nuclear power, telecommunications and space exploration and other advanced infrastructure—the sudden appearance in one decade of more high-speed and mag-lev rail mileage than the rest of the world combined, is one celebrated example—has produced very high rates of multi-factor productivity growth and general economic growth and progress.

China’s policymaking with respect to its internal development, carries over into its relationships with other nations through the Belt and Road Initiative.

To take one of the brightest examples of this policy, a look at the development of the transport system of China with special emphasis on the high-speed rail system (HSR) should be sufficient to illustrate this point.

According to a World Bank report published in 2019, China has made fantastic progress in developing its transport infrastructure. “From 1990 to today, China has added over 120,000 kilometers (km) of railways, 130,000 km of expressways, 3.7 million km of road, and 740,000 km of coastal quay lines to its national transport system,” the report states. Since 2008 China has put into operation over 25,000 kilometers of dedicated HSR lines, far more than the total high-speed lines operating in the rest of the world.

Ironically, the first HSR line was inaugurated right at the point when the financial collapse in Wall Street started to snowball. In early August, 2008, the first fully HSR line in China was opened, between Beijing and Tianjin. The HSR system is by far the largest passenger-dedicated HSR network in the world and currently operates over 2,600 pairs of China Rail Highspeed (CRH) trains each day.

As for current and future plans, the WB report says that while the “Medium and Long Term Development Plan planned for an HSR network of 12,000 km by 2020, the 2016 revision is now aiming for a network of 30,000 km by 2020, 38,000 km by 2025, and 45,000 km by 2030”.

Where to go from here?

Given the economic impact of the Corona lockdown in China and globally, we can imagine that this whole process will be further accelerated. In addition, we might witness the evolution of the Chinese HSR system into the next generation of transport, the Magnetic Levitation system. What these policies of investment have achieved besides recovering from the 2008 crisis, is that it made China the world champion in construction of the most efficient infrastructure with the highest construction speed and lowest costs. This means that China’s competitive edge has increased in the global construction market. Many nations in the world are hungry for this kind of rapid development, but the global financial and economic system has been ill suited for it. The “monetary” system and “credit” system can no longer exist in the same universe to insure sustained economic development for all nations. Therefore, a new global system of credit is badly needed for the “global” recovery from the COVID-19 pandemic. We cannot go back to the pre-pandemic “normal”, because that normal implied a collapsing financial and banking system in addition to social and economic degeneration in the West, and it implies massive poverty in Africa, South America and large parts of Asia. The weakened global physical economy was glaringly exposed by the Corona virus, which showed a world (both in the advanced and developing sectors) that was physically unprepared to tackle it. As the authors have discussed in recent articles and presentations, to deal with this pandemic and deal with the coming ones, the global health system has to be physically built from the ground up, starting with massive construction of infrastructure. Then the making of the Belt and Road Initiative a global practice with the industrial nations in the West and East participating in it for their own benefit and for that of their partners around the world would be possible. This will require a new financing mechanism on a global scale, a new Bretton Woods system. The irony of this situation is that what China has been doing and what the U.S. was doing in the best times of development in the history of the United States, as in the era of President Franklin D. Roosevelt are in harmony. Those who are agitating against China in the U.S. and Britain do not want to have a new paradigm of cooperation between East and West based on the best traditions of both sides. This will be the subject of our next writings.

*Hussein Askary is board member of the Belt and Road Institute in Sweden.

**Paul Gallagher is Economic Editor if the American weekly Executive Intelligence Review.