Hussein Askary, The Belt and Road Institute in Sweden.

A new wave of the thoroughly debunked fake narrative of “China debt-trap” is trying to make a fresh return in Western media, taking advantage of the current global economic and financial crisis that is hitting many nations. Pakistan is admittedly facing a debt crisis. However, this is not unique to Pakistan today. Sri Lanka, Turkey and many countries in Asia and Africa are reeling under multi-faceted debt burdens, in addition to fuel, and food crises. Most of those nations have also been hit severely by the economic and financial consequences of the COVID-19 pandemic. What the media narrative does is that it takes away the global financial and economic crisis and its causes out of the story about a country, and then attributes the problem to the intimate cooperation between that country and China to jointly building the Belt and Road Initiative.

The most acute aspect of this global crisis is the major rise in global energy prices starting already in 2021 but has been augmented by the crisis in Ukraine. With supplies threatened, and sanctions imposed on the largest exporter of natural gas, Russia, prices have hit the ceiling. The rise in fuel prices created shock waves across every aspect of the global economy, especially consumer goods. Added to this, the crisis in Ukraine created a supply crisis in global wheat markets as Ukraine and Russia are major producers, and also threatened the production of food elsewhere since Russia is the world leader in production of fertilizers. Countries that do not have domestic oil and gas resources nor fertilizer production are hit the worst. This applies even to the EU and other industrial nations too, not only poor countries. But the U.S., the EU and Japan can resort to money printing without suffering a global blowback. Developing countries can be severely punished if they do so, and their currencies collapse under the pressure of hyperinflation.

Pakistan has already had a financial crisis which is not new but is worsened by the new global inflation shockwave. As we show here, this debt crisis has absolutely nothing to do with Pakistan’s cooperation with China to build the China-Pakistan Economic Corridor (CPEC). On the contrary, the CPEC is one of the main solutions to this problem.

The simple facts: composition of debt and source of debt

There are two essential facts that are ignored when the media in the West (and also in India) deal with the external debt of Pakistan: 1. The composition of the debt. 2. The causes of the debt. We will discuss these two here. A third factor, which we will not discuss here, is that Pakistan has been a victim of the U.S. and NATO’s decades-long wars in Afghanistan, first in support of the Mujahideen against the Soviet Union in the 1980s, and later fighting the same Mujahideen (now morphed into terrorists) since 9/11, 2011. These wars caused devastating economic loss, besides an incredible human life loss.

Contrary to the narrative, China has played a positive role in Pakistan’s fight to remedy decades of economic stagnation through the CPEC. One of the most important aspects of this cooperation is resolving the infrastructure bottleneck, with power generation and distribution as the key to the country’s economic salvation. It is very important to remember that these power projects are Chinese investments and not loan-financed contracts. They are build-operate-own-transfer (BOOT) projects. The Chinese investments are recouped through sales of electricity to the Pakistani market over a specific period.

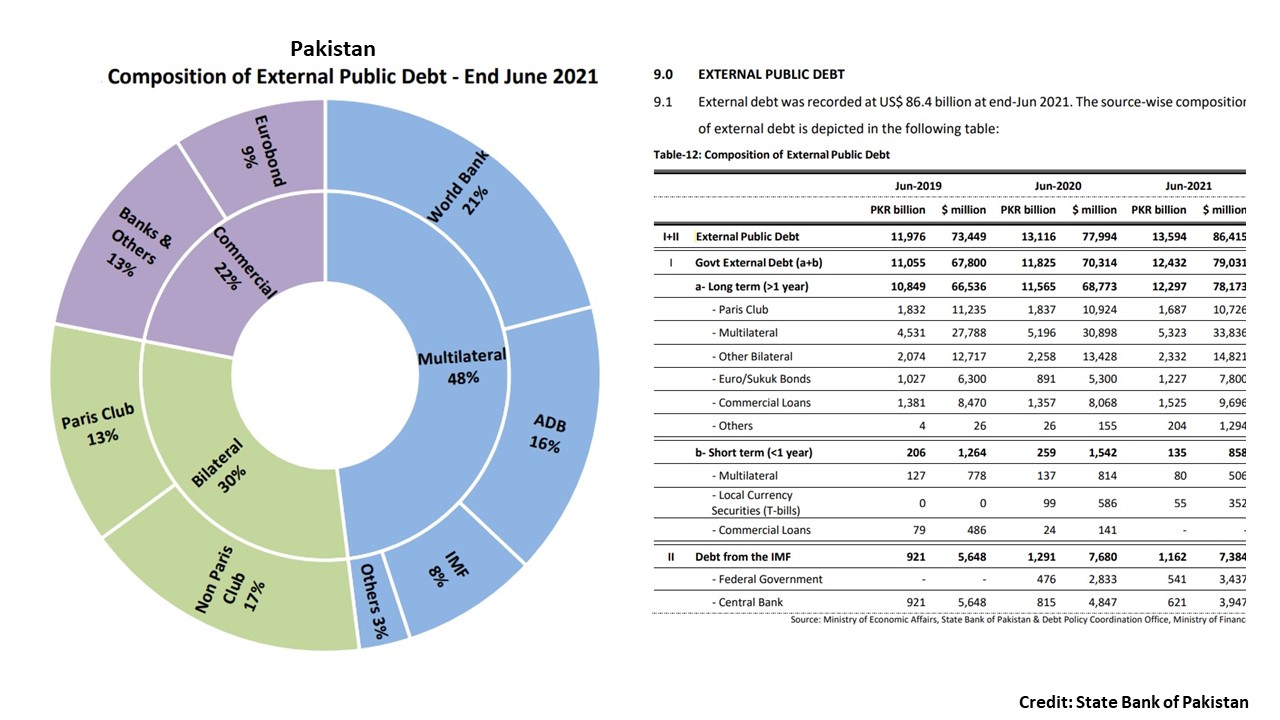

1. Composition of Pakistan’s external debt. China’s share of Pakistan’s external debt, compared to that of Western and Asian nations and institutions, is relatively small, reaching no more than 10% of the total. This fact was clearly explained by Pakistani political economist Shakeel Ahmad Ramay in a webcast / podcast produced by the Belt and Road Institute in Sweden (BRIX). .

According to data provided by the State Bank of Pakistan (SBP) and Finance Ministry and reviewed by the BRIX, Pakistan’s creditors are mostly Western-controlled financial institutions such as the World bank (21%), International Monetary Fund (8%), Asian Development Bank (*) (16%), the Paris Club (13%) and international commercial banks and bond markets (22%). China’s share is included in the 17% percent non-Paris club states dominated by the Gulf states, and also in the category of commercial loans.

Therefore, Pakistan’s fiscal policies have been dominated by conditionalities imposed by these international institutions to a large extent for many years, but emphatically since 2016 when Pakistan’s economy witnessed a severe downturn. Bailout negotiations were characterized by demands of imposing austerity and reducing government investments in infrastructure and public services. These typical demands are terribly counterproductive in developing countries and lead to lowering the productivity and competitiveness of the domestic economy.

Pakistan’s total external debt (public and private) in December 2021 was US$ 130 billion, and Debt service for 2021 was US$ 10,9. This compares to US$ 116,5 billion in 2020, and 93 US$ billion and debt service of 6 US$ billion in 2019.

Some relief was offered from international sources when in 2021 Pakistan became eligible for the Debt Service Suspension Initiative (DSSI) in the aftermath of the Covid-19 pandemic. The DSSI is a World Bank-administered G20 initiative.

Domestic debt is larger and has risen in a similar manner in the same period and is Equivalent in local currency, Rupee, to US$ 127 billion in 2019, then reached US$ 138.5 in 2020, and finally in 2021 rose to US$ billion 167. So, the rise since 2018 can be said to be somewhat dramatic.

2. Main causes of the debt crisis:

A. trade deficit: One of the main causes of Pakistan’s resorting to borrowing externally is financing its current account deficit (CAD) where its imports have outpaced its exports for many years. A look at what commodities are the largest items of the bill of imports of Pakistan reveal why the CAD has been increasing dramatically.

The main imports in 2020 were: Refined Petroleum ($3.87B), Petroleum Gas ($2.24B), Palm Oil ($2.15B), Crude Petroleum ($1.92B), and Raw Cotton ($1.68B). The fact that petroleum products dominate the imports bill point to the fact that the rise of these items since early 2021 but most dramatically since the start of the Ukraine crisis in February 2022, will make this deficit even deeper and force Pakistan to borrow even more hard currency to pay for its energy bill.

It is important to note here that Pakistan still replies for its power generation on expensive imported oil and gas up to 50% of its total installed generation capacity of 40,000 Megawatts: oil (15%), Natural gas (12%), and Liquified Natural Gas (25%). Other sources are Hydroelectric power (26%), coal (9%), Nuclear (8%) and renewable solar and wind (5%). This problem will be gradually resolved when more power from CPEC hydropower, coal and nuclear, and renewables come online in the next 3-5 years. This will tackle the major problem of trade deficit caused by expensive imports of oil and gas. Thus, the external debt problem will be reduced.

At the same time, Pakistan’s export items, mostly textiles, don’t seem to increase as dramatically in price or value although it achieved important growth in the past three years.

The trade deficit increased greatly about 83% year on year (2020-2021) reaching US$ 32 billion. Furthermore, it reached an all-time monthly high in January 2022 hitting US$ 2.6 billion. This record is being broken each month this year and will very likely break the 40 US$ billion level by the end of this year.

This is the main cause of alarm in the country, which will have to resort to the IMF, international markets at higher interest rates, and to friendly countries for bailout. This will add more to the pile of external debt.

B. Circular debt: The power sector in Pakistan has been the main source of economic trouble for many years. Lack of electricity means load shedding for hours every day. No industry can survive such circumstances. The main industries of the country witnessed reduced productivity and loss of revenues for years. However, with the increased generation capacity, including from CPEC projects being gradually completed, the problem is no longer the generation capacity but delivering and financing these deliveries efficiently. The issue here is a phenomenon called “circular debt”. There has been an accumulation of delays in payments of government subsidies to power distributors, mainly government enterprises. When these enterprises do bot receive the money from the government, they fail to do two things; first maintain and develop the transmission lines and systems; two, they fail to pay the power generating companies. The power generating companies need to be paid to buy fuel and develop the electricity production capacity. When the system fails to deliver power regularly to the customers, the latter decline to pay the bills. This leads to further financial shortages for the enterprises distributing the power, and this in turn affects the power producing utilities. This cascading debt spiral is called “circular debt”, which is estimated to have reached the equivalent of US$ 14 billion this year.

The government is caught in a trap, because if it lifts the subsidies it is offering to the consumers since the 1960, it runs the risk of social and political unrest due to rising electricity prices determined by the “market”. Not only the poor sectors of society, but even great numbers of small businesses with low revenues will not manage the rising power prices. Therefore, the government is choosing a middle path by slightly raising the electricity tariff rather than lifting the subsidies, according to Nadeem Babar Chairman of the Prime Minister’s Task Force on Energy Reforms. This process will gradually reduce losses and ease the constrains on the transmission and distribution systems.

Others, backed by the World Bank, recommend a total lifting of subsidies while proving financial support to the neediest citizens and enterprises. Such a sudden move, however, might create a chock with major social and political repercussions in a politically very fragile nation, especially since the ouster of Prime Minister Imran Khan in early April.

Role of China and the CPEC

The increase in the productivity of the Pakistani economy is the most important solution to the crisis, but it is not a quick fix. While financial experts and international institutions focus on “reforms”, although some of these are very necessary, Pakistan must race to completing the Phase I of the CPEC (infrastructure building) and launch Phase II (industrial parks and agriculture sector development). These two phases will reduce the trade deficit and diversify the sources of income of the nation and achieve greater growth.

Newly built Industrial parks and special economic zones are attracting both Chinese and international investors. These SEZs are located on or near transport and power transmission arteries of the CPEC. However, the pace of investments in these parks is still slow.

For solving some of the urgent debt issues, Pakistan is approaching China for debt relief or bail out through injections of foreign reserves into the Pakistani Central Bank to stabilize the balance of foreign currency reserves and greater confidence in Pakistani finances. China did accept a Pakistani request to rollover a major US% 4.2 billion repayment on March 29 providing a major relief. This was announced after the meeting of Foreign Minister Wang Yi with his Pakistani Counterpart Shah Mahmoud Qureshi in Anhui Province. This tranche of debt repayment is not related to CPEC projects, but rather investments made the Chinese State Administration of Foreign Exchange (SAFE). Pakistan is likewise resorting to wealthy Gulf states for similar financial support.

Debunking the debt-trap is easy, but..

Proving the fallacy of the China “debt-trap diplomacy” narrative is relatively easy. A simple check of the facts from official sources suffices to show why it is a fake story. The debt-trap narrative, especially the case of Sri Lanka, has been thoroughly debunked by Dr. Deborah Brautigam and associates in the School of Advanced International Studies (SAIS) in Johns Hopkins University through the study of thousands of pages of official documents. This author’s own work in this area has also explored this matter by checking facts from the official sources. Yes, it takes some time-consuming homework, but the revelations are rewarding. The challenge is not in sorting facts from fiction but encountering the massive propaganda machine of the main stream media in the West, which spews out wave after wave of such stories. Repeating these fake stories does not make them into truths, but the psychological impact and the doubt they plant in the minds of the victims of this exposure are difficult to encounter without an equally large exposure to the truth through mass media.

(*): Despite what the name suggests, the Asian Development Bank’s major donors are Japan and the USA, but also include Australia, Canada, France, Germany, Britain and a few Asian countries like China, India, and Indonesia. Its policies are similar to those of the World Bank and IMF.

Related items:

Will the China Pakistan Economic Corridor Fall Victim to Political Turmoil in Pakistan?

Western Banks Not China behind Malaysia’s Corruption Scandal!