By: Shexiu Huang * and Hussein Askary**

The probability that the gifts you, your family, or your friends got for Christmas were produced as a whole or in part in China is very high. At the same time, the U.S. Administration and the EU keep putting obstacles on the road of the global supply chain that bring humanity these gifts. The global supply chain has become so entangled, but also so incredibly multifacetedly connected to China, that attempting to decouple the United States and the European Union’s economies from China will be tantamount to committing economic suicide. This will be a disaster for the global economy itself. The issue is not limited to Christmas gifts, but to almost every thinkable product that affects our lives from medicines to spaceships. New U.S. restriction on semiconductor production cooperation with China is the latest and most dangerous part of this policy. To attempt to put the political scissors into action to cut this entanglement has become a physical impossibility. In physics, “quantum entanglement” is simply explained as: a phenomenon that explains how two particles or more in an “entangled system” can be intimately linked to each other even if separated by great distances. Despite their vast separation, a change induced in one will affect the others. In this sense, the particles are not considered as individuals, but an inseparable whole.

Let’s see, first, what a supply chain is!

What is a supply chain?

A supply chain is the network of all the individuals, organizations, resources, activities, and technology involved in the creation and sale of a product (Ben Lutkevich). In industrial processes it starts with the extraction of raw materials, refining and manufacturing them into bars, sheets, pipes etc (if they are metals). These semi-finished products are then sent to factories where the are incorporated into final products like mobile phones, computers, household appliances, furniture, cars, or airplanes. The chain of activities from this stage all the way to the stage of bringing the final product to the final user or consumer constitute the “the supply chain”. It includes both digital and physical aspects in a very sophisticated process where the creativity of the human individual and his/her team is the core of the whole process. In agriculture it is a similar process but does not start in the farm as the well-known expression “from farm to fork” indicates, but much earlier in the industrial supply chain where the machinery, fertilizers, and even the seeds are processed and transported to the farm.

Value chain

Imbedded in the “supply chain” concept is another economic notion called the “value chain”, where value is added to the product as it passes from one ring of the supply chain to the next. A good example is the production of aluminum and plastics. There is no such an element in nature as aluminum or plastics. They are “created” in a chemical process from basic natural raw materials. In the case of aluminum, bauxite, which is a useless sedimentary rock, is extracted from the deposits in the ground. It is then refined and turned into Aluminum Oxide (alumina), but still not usable as a metal. The alumina is then processed into usable aluminum through an electrolysis process. Then the metal enters all kinds of industrial processes to turn it into sheets and bars. These then are used in all kinds of tools and other consumer products. Not only the location of each of these processes changes, the value of the product resulting from each process increases by one or more degrees of magnitude at each stage (*1)

The same goes for plastics. Petroleum products (oil and gas) are not only used in the production of energy, but in much more valuable processes such as the production of plastics, dyes and paints, glues and adhesives, detergents and cleaning products, and even cosmetics and textiles like polyester fabric. Synthetic fertilizers, that enable the 8 billion people on our planet Earth and their cattle to eat are a product of natural gas. One of the main reasons we have a global food crisis today is due to the fact that Russia and Ukraine are not only among the largest producers of grains in the world, but also the source of much of the synthetic fertilizer. The value of one barrel of oil (today at ca 80 US$) can be augmented by orders of magnitude the higher that sticky oil climbs in the value chain beyond its use as fuel. China imports the equivalent of 200 US$ billion annually of oil and gas. But the sales of its chemical industries is about 1,5 US$ trillion, according to European Chemical Industry Council. It deploys 25,000 companies and employs millions of workers and engineers directly and indirectly. China’s chemical industry sales are larger than the four following nations in ranking (U.S., Germany, Japan, South Korea). Interestingly, except for the U.S., none of the other nations are oil or gas producing countries. They import raw oil and gas and export finished products at a mesmerizingly higher value.

Domestic & global supply chains

The geographical distribution of supply and value chain activities are spread across many countries. For example, a car is not produced in the same place. The different components are made in different parts of the world and at the final stage they are assembled in a plant in some country. Prior to the production of the components, there is the process of transforming raw materials into these components, in what is called upstream activity. The production of the final products and marketing them to the consumers is the downstream activity. All the activities require a smooth transport and logistics system nationally and internationally.

Transportation and logistics: For a global supply chain to function it relies transport by sea, air, and rail. Rail freight has gained a great importance in the global supply chain especially since the launching of the Belt and Road Initiative in 2013, making rail freight indispensable in many regions of the world (see BRIX article on the existential importance of the China-EU express rail. A domestic supply chain typically uses trucks, rail, and river transport, and to a lesser degree air. In the domestic supply chain, all the activities from production to distribution are within the same country, whereas in the Global supply chain different parts of the process spread across different parts of the world. For example, many components for cars, laptops, and smartphones are made in China. The global supply chain is more vulnerable to geopolitical, security threats and to natural disasters. The COVID-19 pandemic outbreak in 2020 temporarily wreaked havoc in the global supply chain. The fight against the pandemic in China and its zero-COVID policy, resulting in lockdowns that were imposed in response to the COVID-19 outbreaks, lead to factories being temporarily shut down and cities put on silent management mode in early 2020. Production was disrupted, and supplies of important components, for example car spare parts, caused the auto-industry in Sweden to shut down temporarily. So, without these components, and the transport of these, the final products cannot be made.

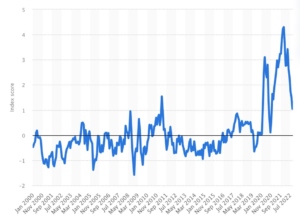

Global supply chain pressure index monthly 2000-2022

https://www.newyorkfed.org/research/policy/gscpi#/overview

The higher the index, the more volatile the supply chain is. Before the COVID-19 pandemic, the index fluctuations were maintained within a stable range between -1.58 and 1.54. But after the outbreak of COVID-19 pandemic, the pressure index reached up to 3.1 in April 2020, and then dropped to nearly 0.11 in November 2020. In December 2021, it skyrocketed to a record high at 4.3. In the year of 2021, China has taken stringent measures to contain the spread of the virus for the sake of people’s health. The year 2022 saw one peak in April at 3.42, since then the pressure index has kept falling as the country slowly began to ease the covid-restrictions. The index considers transportation costs using data on ocean shipping costs and supply chain-related components from the Purchasing Managers` Index (PMI) surveys for China, the Euro area, Japan, and South Korea.

Why companies, like Apple, prefer to produce in China?

Unlike the commonly accepted legend that global companies are investing in production in China today is due to the low cost of labor, there are other reasons for this phenomenon. While the low cost of labor was a clear motivation in the early days of “opening up” where international companies utilized the free economic zones established by China in coastal areas in the late 1980s and early 1990s, the situation has changed dramatically. The cost of production is lower in China than in the West is due to the efficiency and economy of scale.

In the past two decades, China has established the world’s most advanced and most-integrated industrial system in the world within its borders. China is the only country in the world which has obtained all industrial categories listed in the United Nations industrial classification (China Daily). It has also built the most sophisticated transport and logistics system inside the country, so that components of products can be shipped around the country from where they are produced to where they are used in breathtaking speed. China’s labor force amounted to 780 million individuals in 2020. Of these there are 200 million highly skilled industrial workers and engineers who can be deployed and relocated at ease at almost any location or field of work. This enormous flexibility is incredibly important in times of fluctuating growth, decline or rise, or shift in economic strategies. China’s economy is a highly centralized one, making it a stable and waterproof system.

In 2021, China accounted for 30 percent of the global manufacturing output , according to China State Council Information Office. This very well-organized and relatively predictable industrial system is the dream of any large company that looks forward to a steady and flawless production process. In addition, a Chinese population of 1.4 billion people with around 400 million middle-income group, makes the internal market size extremely attractive for producers of consumer goods, like Apple. This market will become even more so in the coming decade when approximately 400 million more people will be added to the middle-income category. As described in Part One and Part Two of the BRIX series on the 20th National Congress of the Communist Party of China (CPC), the government is intending to expand the role of the domestic market and levels of consumption of the population as the main driver of growth in the coming decade.

China is a leader in many other cutting-edge technologies such as big data, artificial intelligence (AI), fintech, fifth generation of telecommunications (5G), electric and autonomous vehicles, robots, and drones, and one of the world’s largest investors in and users of these digital technologies. With a strong venture capital industry focusing on fostering advanced digital technologies and innovations, China is home to one third of the world’s unicorns (defined as a start-up company with a value of over USD $1 billion), most of which are digital technology related.

In 2017, the CEO of Apple, Tim Cook explained in an interview with Fortune Magazine (video) the reasons why his company produces in China as saying: “The number one reason is the quality of the people”. He continued saying that China has extraordinary skills. And the part that’s the most unknown is there’s almost two million application developers in China that write apps for the iOS App Store. China has moved into very advanced manufacturing, the intersection of craftsman skill, precision tooling, and sophisticated robotics and the computer science world. All these factors combined makes it more attractive to big companies, like Apple, to produce in China.

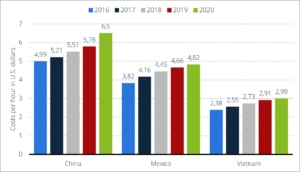

“There’s a confusion about China”, Cook said, adding that the popular conception is that companies come to China because of low labor cost. “I’m not sure what part of China they go to, but the truth is China stopped being the low-labor-cost country many years ago,” he indicated. This is evidenced by the table below (*2) . He emphasized that “the reason is because of the skill, and the quantity of skill in one location and the type of skill it is.”

China is not a lonely planet

A major obstacle in making these matters translucent for the public is that political leaders, political analysts, and a great part of the mass media in the West see the world and relations among nations as a zero-sum game. If one grows, the others shrink. Besides, China’s growth and advancement is considered a threat to the West due to difference in political systems. The projection of the zero-sum game and geopolitical mentality of the fighting empires of Europe on China is misplaced and inadequate because China’s history and social character is different than that of the West.

The reality is that despite all kinds of political, security, and military problems, for many decades the world has been moving towards greater and tighter economic integration. To believe that one nation or a group of nations can secure their people’s needs by building a wall against one or more nations is a dangerous and delusional proposition. Economic sanctions imposed on Russia by a group of nations (U.S., EU, and NATO) backfired massively against the economies and wellbeing of the people of Europe and even created major crisis for many other nations in Africa, Asia, and Ibero-America.

China considers its economic growth and progress as beneficial to the rest of the world. “A community of a shared future for mankind” is not a political slogan, but a philosophy that is being implemented by China through the Belt and Road Initiative, for example.

If we go back to the “supply chain” question and the tight economic “entanglement” between China and the Western economies, we can find many important examples on the obsoleteness of the zero-sum-game theory. China’s rise to become the number one producer of steel is a good example. From 2011 to date, China has been producing more steel than the rest of planet combined (In 2020, 1,064 million tons out of 1,877 million tons world total). China’s ability to reach this level of production was very much dependent on Western companies exporting the technology and steel production furnaces and components to China. One appropriate example is the giant Italian steel plant producer Danieli. This company’s revenues from international operations were around 750 US$ million in 2003. By 2010, they zoomed to 4 US$ billion thanks chiefly to its exports of steelmaking equipment to China. In 2020, the company reported exceptional growth in the Chinese market in its annual report and forecasts for 2021. Danieli continued in 2022 to garner large contracts from Chinese steel producing companies. An important aspect of this development has been the constant modernization of the Chinese industrial base with the steel sector as its spearhead. The CPC’s new plans for the “green transition”, as explained in a BRIX report in 2021, are opening the gates for exports from innovative European companies of new clean technologies to China. Danieli last year received orders for new hydrogen-based ovens from the Chinese Baosteel Zhanjiang (subsidiary of Baowu, the secong-largest steelmaker in the world). The steel plant to be opened in Guangdong Province in 2024 will be the largest hydrogen-based steel plant in the world. Thus, China’s progress means much for the progress of Western companies and the people working in their factories in Europe itself and for their families. China’s efforts to industrialize Africa through the Belt and Road Initiative will offer many such opportunities for advanced industries of Europe and the U.S.

Therefore, it is not only the world that needs China, but China itself needs the world for its economic development and growth. This is the very simple fact that geopoliticians have a problem understanding.

Challenges to supply chains: the semiconductor entanglement

While there are many risks in the function and handling of the global supply chains, we focus on the two most obvious ones that are a result of real-life experience in recent months. One is related to global pandemics, as shown in the COVID-19 pandemic impact on the global supply chain in 2020 and 2021. The other and more serious one is the political one: the constant threat of “decoupling from China” uttered by U.S. and European politicians.

The Covid-19 pandemic, although its impact is receding as all nations including China have lifted all restrictions imposed earlier, should be studied as an important lesson for dealing with such eventualities in the future. Epidemics and pandemics are part of life on this planet. While preventing them has the priority in the considerations of nations and international organizations like the World Health Organization, nonetheless, learning how to deal with them if they break out is of the highest priority. The rather disorganized reaction by different nations to the pandemic with almost each nation making its own policy, sometimes in a panicked way and sometimes in a completely selfish manner made it almost impossible to have a unified and effective reaction to the corona virus. The on-and-off closure of production zones can hugely impact the delivery time, thus increasing the lead time to deliver the products to producers or consumers. Yet, as the covid-19 restrictions are loosened especially in China, the domestic supply chain will be more secure. And it also benefits the global supply chain.

The political challenge is the more dangerous one, since it is irrational and can come suddenly based on miscalculations by politicians who are oblivious to the physical economic requirements of their societies and how the global supply chains that serve their societies work. The latest decisions by the U.S. Administration to put restrictions on the export of specific types of sophisticated semiconductors to China by U.S. and other suppliers is one such shot in the dark.

The complex world of semiconductors

Semiconductor devices, usually integrated circuit (IC) chips, are the most important electronic component in almost every modern electric and electronic device or tool from computers to mobile phones, household devices, electric cars, solar panels, airplanes, and spaceships. The chips are designed and fabricated to conduct specific control and operation mechanisms in every one of these products.

The global process of manufacturing semiconductors or chips and deploying them inside machines and devices is one of the best examples of the global supply chain and the inseparably entangled net of corporations and countries involved. The development of modern semiconductors went through a long process of research and development mostly in the United States since the late 1940. That’s one reason why the U.S. is a world leader in “design” of semiconductors. But it is not the leader in producing them as we will explain. The authors of this article found many misleading headlines describing one or more companies as the “worlds largest producer of semiconductors”. There is no single company in the world than can produce semiconductors from A to Z.

The production of a finished semiconductor device / chip starts with the extraction of the most important component from sand! Silicon dioxide is one of the most abundant materials in earth’s crust, but it has to be distilled into silicon in an industrial refining process. That process then results in the production of extremely pure mono-crystalline ingots (a thick “salami sausage” of silicon). The sausage, which can vary in diameter from 100 to 300 millimeters in diameter, is then sliced and polished into discs or “wafers” thinner sometimes than one millimeter. Such a process is typically conducted by companies like Bosch in its Dresden (Germany) plant or the larger Japanese companies Shin-Etsu Chemicals and Sumco. The surfaces of the wafers are then treated in a series of chemical and optic processes to induce different conductivity levels in them. One such a process is optical lithography or photo lithography that etches patterns on the thin wafers using sophisticated lights and lasers of deep ultraviolet or extreme ultraviolet or x-rays that are in nanometer magnitudes. One of the world leaders, if not the sole one, in lithography is the Dutch company ASML. The technologies and machines this company uses and produce are next to science fiction in their complexity and precision. However, as the company website itself states “ASML doesn’t make chips. ASML makes photolithography machines, which our customers use to mass produce chips.”

ASML has branches servicing customer companies in Europe, the U.S. and Asia (including in China: Shanghai, Shenzhen, Beijing, Hong Kong, and Taiwan). These patterns etched by ASML are a preparation for “implanting” the specific “transistors” on the surface of the wafers. This process is done by other companies in other countries. The production of the transistors themselves is made in a variety of locations in the world by companies like Japanese Toshiba and Panasonic, German Infineon, and China’s CR Micro. Known companies that do the large-scale final processing and production of the finished chips are for example Taiwan’s Semiconductor Manufacturing Company (TSMC), South Korea’s Samsung, and China’s Semiconductor Manufacturing International Corporation (SMIC) in Shanghai.

Structures of global semiconductor division of labor

The U.S. leading edge in this technology is due to the long-term research and development process that have lasted for decades, a process that should be given credit and respect for its incredible contribution to global economic and technological development. Semiconductors were actually invented in the U.S. In the immediate decades following WWII, semiconductor and transistor production process was “vertically” organized, i.e., the same company or associated companies within the U.S. designed and produced the semiconductors. Some companies even produced or designed the machinery and tools that were involved in producing the different components and processes involved. The final products, ICs, were then installed into devices and products in American factories. By the 1980s and the diversification of the world economy and emergence of industrial capacity in Europe, Asia like in Japan, South Korea, and Taiwan, and as a result of globalization, these companies became more and more specialized. Their main role became the design of the semiconductors and providing services for companies involved in the now outsourced production process. This process evolved so dramatically that by 2020, U.S. manufacturers stood for only 12% of the global production of semiconductors. These American companies became known as “fabless” (non-fabricating) companies, and the leading ones are Qualcomm, AMD, Apple, ARM, Broadcom, Marvell, MediaTek, Intel Corp, and Nvidia. The Chinese telecom giant Huawei has also recently developed its own design for chips used in its telephones and other telecom equipment. These companies outsource the production by contracting other companies called “integrated device manufacturers” such as Taiwan’s Semiconductor Manufacturing Company (TSMC), Samsung, and Semiconductor Manufacturing International Corporation (SMIC) in Shanghai (to name a few) to produce the final products. The latter three are an example of the “semiconductor foundries” that represent the “fabrication” arm of the “fabless” major ones. The contracts between the two are called “pure play” contracts. But the foundries need the involvement of all the above companies in the U.S., Europe, and Japan to acquire the design, tools, and materials for manufacturing the integrated devices.

Therefore, when politicians interfere into this delicate arrangement between this incredibly intertwined supply chain, they risk putting the sticks into the wheel of the global economy as a whole. If they assume that China’s role is not necessary for the production process of the semiconductors, they neglect the fact that these semiconductors end up in China for the most part to be used in products that are essential for the U.S. and the EU.

Why there is a shortage of chips?

When COVID-19 broke out globally in 2020, there was first a shock to the production capacity as manufacturing processes in East Asia were limited by the lockdowns. Second, a surge in the usage of electronics such as laptops, tablets, and internet routers for conducting both work and study at home in many countries in the world created a massive demand for semiconductors. But supply could not catch up with demand. Manufacturing a finished semiconductor wafer, known as the cycle time, takes about 12 weeks on average but can take up to 14-20 weeks for advanced processes. To perfect the fabrication process of a chip to ramp-up production yields and volumes takes even much more time – around 24 weeks, according to specialized websites.

Then came new U.S. sanctions against China’s semiconductor sector.

U.S.-imposed sanctions

Adding salt to the wound, on October 7, 2022, the US Department of Commerce unveiled new sanctions imposed on China related to the export of advanced semiconductors, equipment, technology and services delivered by persons such as U.S. citizens, non-American green card holders, and foreign nationals living in the U.S. This practically forced those persons working in such Chinese semiconductor firms like Yangtze Memory Technologies Co. Ltd (YMTC), ChangXin Memory Technologies (CXMT), Shanghai Semiconductor R&D Center Jiading Factory, and Hangzhou HFC Semiconductor Corp. to resign shortly after that, according to reports. In addition, US-based suppliers of chip equipment, including Applied Materials, KLA Corporation, and Lam Research, stopped their corresponding services and support in China and withdrawn their US workers from China. SMIC company was on the list of sanctioned companies, which meant that SMIC was banned from using American technology or importing tools and materials produced by American companies or other foreign companies using American technology. SMIC manufactures silicon wafers based on proprietary designs provided by its customers or third-party designers. After the sanctions imposed by the US government, the American companies who originally worked with SMIC have to shift their business to other companies, while they’re all in full production capacity, and the production lead time is long, thus creating a severe shortage of chips globally.

China’s response

China has responded immediately by filing a complaint with the WTO in early December, as these sanctions are violating the free trade agreements, according to the Chinese side. The U.S. side used the pretext of protecting “national security” to ban these advanced semiconductors from China, arguing that they might be used for military purposes. The U.S. is also putting pressure on other nations like the Netherlands and Japan to treat China in the same way.

Otherwise, China has not responded in any other tangible way with countermeasures against the U.S. or American companies. However, China has a medium to long-term policy of massively investing in research and development in hi-tech fields to reduce its dependency on the U.S. and other foreign sources of such sensitive technologies. This policy was reaffirmed in the 20th National Congress of the CPC in October. China has become increasingly aware of the danger of the “decoupling” policy promoted by the U.S., especially since the Trump Administration waged its trade war against China starting in 2018.

However, there are short term measures and developments that can create a soft landing for the Chinese side. The South China Morning Post reported earlier this month on a speech delivered by an official from the China Semiconductor Industry Association, Wei Shaojun, saying that while the growth rate for China’s semiconductor industry is slightly down since last year, the domestic manufacturing companies are growing rapidly and are accounting for an increasing share of the internal market demand. Just in the last year there has been a 15% increase in Chinese chip designing companies, now up to 3,243.

The sanctions are pushing China to take faster paces towards establishing its “vertical” and full set supply chain in this industry. “Not only Chinese companies but foreign companies operating in China attach greater importance to the security of supply chains, which has, in fact, fueled a wider use of domestically designed chips,” he said. Shaojun said China’s approach thus far has been simply filling holes left by the US trade restrictions, but that China is now preparing to change course. According to SCMP, Wei said that China instead “will carry out a complete redesign of its strategy to better leverage resources and use a variety of ways to boost the industry.” The new gameplan will be robust enough to last until 2035 at least.

China has already made headway in replacing many of the capabilities which were previously coming from overseas advanced chip manufacturers, although the challenge that remains is that of producing the most advanced 5nm-and-below microchips. It is reported, however, that China’s SMIC already has developed 5nm technology, and will be ready for production by 2025. China Daily , in a lengthy report on how China is going to cope with this semiconductor challenge, quotes Zhong Xinlong, senior consultant at the China Center for Information Industry Development Consultancy, who said, “the [US export] bans are also making Chinese chip companies more determined to achieve breakthroughs in crucial technologies.”

China Daily cites data compiled by Bloomberg in June 2022, concluding that Chinese chip companies are also growing faster. “In the past four quarters, 19 of the world’s 20 fastest-growing chip industry companies were based in China, compared with just eight the previous year,” it reported. In addition, more promising startups are emerging. As of November, there were 50 semiconductor unicorns, or startups worth more than $1 billion, in China. Their total valuation was 858.4 billion yuan, according to New Fortune, a financial services platform. Of these companies, 25 are chip designers, eight specialize in general processing units, and five are auto chip companies. Unicorns have also emerged in semiconductor materials, chipmaking equipment and electronically designed automation tools, with the aim of narrowing the gap between China and the US in these areas, New Fortune added.

While these sanctions will temporarily destabilize parts of the advanced semiconductor industry in mainland Chinese, it will definitely create supply shocks in every imaginable advanced product on this planet which depends either completely or partly on China ability to produce and function as a modern industrial system.

It is obvious from the review we have made of the incredible interdependence of all the global companies in this and other sectors that there is no way to de-entangle this massive supply chain where China is at the center of it. It would be tantamount to committing economic suicide.

You cannot eat chips

When you bake a loaf of bread, you need salt, yeast, water, and flour! However, can you bake the bread without an oven? This is the question anybody watching this cat and mouse show around the semiconductors should ask. As much as one cannot eat salt, or yeast, or flour, it is equally useless to eat semiconductors. Semiconductors or chips are not an end product in themselves, but a key component in many sophisticated products that are dominating almost all human activities manned and unmanned on our planet and in our solar system.

The fact that most of the semiconductors produced around the world are sent to China to be inserted in products that are then sent back around the world, including and to a great extent the U.S. and the EU themselves, should make one pause and wonder about the rationality of the decision makers. As one report in Harvard Business Review stated as early as the Summer of 2021, the implications of decoupling for foreign enterprises are staggering. “For example, today Intel exports billions of dollars’ worth of microchips to China, whose market accounts for about 50% of global semiconductor demand”. If you cut China from this process, there will be no products used and shipped to you at a reasonable price and securely. There will simply be no proverbial loaf of bread on the table of the global economy.

Conclusion: The lessons of COVID-19 pandemic

The importance of China in the global supply chain was made crystal clear when the COVID-19 pandemic broke out. The shear panic in European and American hospitals and healthcare centers for the lack of the most basic personal protection equipment (PPM) in enough quantities and the inability to produce them in the U.S. and the EU, made it imperative that China puts all its industrial capacity in the service of producing these and other medicines and great number of ventilators and other life-saving medical devices and equipment for the rest of humanity.

The shocking dependence of the U.S., including its military forces on China for supplying medicines and other materials was revealed in statements made by the Chairman of the Joint Chiefs of Staff Gen. Mark Milley, who testified in the U.S. Congress in early March, 2020. According to a report in Voice of America Milley, in answering a question about how exposed the U.S. was to Chinese products, he said: “It is a vulnerability to have a country such as China manufacturing high percentages — I don’t know if it is 97%, 98% or 80%, whatever it is — but I do know it is high percentages of the ingredients to [the] American pharmaceutical industry across the country, both military and civilian.” In this same report, U.S. Commissioner of Food and Drugs Dr. Stephen Hahn was cited as saying that “currently, 20 drugs come only from China”. Furthermore, the report added that “it is estimated that more than 90% of active ingredients in antibiotics in the U.S. market are sourced in China.” Europe is not far behind the U.S. in this respect. Given the almost total dependency of the United States of America on China, wouldn’t it be prudent to keep a friendly relationship with that country.

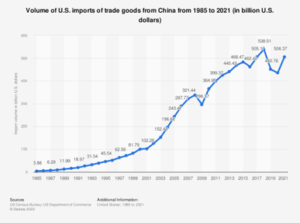

Despite the feverish and often egregious attacks on China by President Trump and his State Secretary Mike Pompeo, China did not ban the export of medicines and medical equipment to the U.S. On the contrary, Chinese exports to the U.S. increased during 2020 and 2021.

In May 2022, the China Maritime Silk Road Trade Index (STI) showed that China’s import and export trade indices to the United States were 120.38 and 208.88 points, respectively. The import index for China’s imports from the U.S. increased by about 15.4 percent from the previous month and 21.2 percent from the same period of the previous year. In addition, China’s export index to the United States also grew by 12.9 percent over the previous month and 15.7 percent from the same period of the previous year.

While it is strategically imprudent for a country to be so reliant on foreign sources for such crucial needs of society, the nature of the global trade globalization since the 1990s have become such that one nation cannot by itself produce all its needs. Regulating the relations of trade on a fair and secure basis among nations can create a healthy global division of labor. Mutual trust and goodwill are indispensable. China itself cannot produce the advanced semiconductor components it needs and is dependent on foreign sources. But to use that vulnerability to blackmail and impede the development of China and other nations is both immoral and suicidal in the entangled world of today. For the U.S. Administration and the EU to support and invest in the repatriation of the semiconductor and other industries back home is a legitimate goal, although there are many question marks regarding the ability of the U.S. and EU physical infrastructure and human resources of sustaining such a large and advanced activity. Besides, can the U.S. and even Europe efficiently and at a reasonable cost produce the products that these semiconductors are inserted in them to run? The obvious answer today is “no”. In any case, the desire of the U.S. and the EU to become more independent and stronger economically is fair play. However, to deny China and other nations the right to acquire these technologies and develop their economies is foul play.

(*1) Read the description of this process by Australian Prime Minister John Gorton in a speech he delivered in September 1970 … https://pmtranscripts.pmc.gov.au/release/transcript-2197 ) “I have been talking of bauxite. Let’s look at what is involved here. One million tons of bauxite from Weipa or from Gove earns $ 5 million for export. If it is converted to alumina, the equivalent of its earnings is some $ 30 million. If that alumina is converted to aluminum, ingot aluminum, it would be worth $ 120 million, and if, finally, that ingot aluminum is fabricated into aluminium products then it would be worth $ 600 million.”

(*2) Manufacturing costs are rising in China. In 2018, manufacturing labor costs in China were estimated to be 5.51 U.S. dollars per hour. This is compared to an estimated 4.45 U.S. dollars per hour in Mexico, and 2.73 U.S. dollars in Vietnam.

Source(s): IHS; Website (SourceToday);

* Shexiu Huang, Postgraduate, School of English for International Business, Guangdong Institute for International Strategies, Guangdong University of Foreign Studies.

** Hussein Askary, Vice-Chairman of the Belt and Road Institute in Sweden – BRIX

This article is part of a cooperation program between the Belt and Road Institute in Sweden (BRIX) and the Guangdong Institute for International Strategies, Guangdong University of Foreign Studies, People’s Republic of China. Ms. Shexiu Huang participated as an intern in this program in the Spring-Spring period of 2022-2023. Previous joint article in this cooperation is “China-Africa Belt and Road Cooperation in Education: Development and Prospects”.